IFRS asset accounting

examples

- Asset with a change in economic life, impairment loss, revaluation

- Asset with increase in estimated useful life

- Asset with decrease in estimated useful life

- Asset subject to impairment

- Asset with reversal of impairment

- Asset with revaluation

- Asset with reversal of revaluation

- Asset with increase in residual value

- Asset with decrease in residual value

- Asset with increase in estimated useful life and reintegrated depreciation

Asset with decrease in estimated useful life

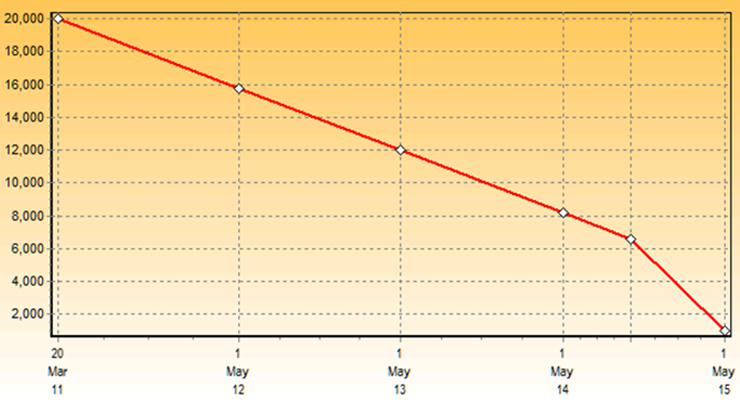

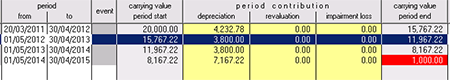

Background: Quality Pages provide transcription services and they buy a set of second-hand high-speed scanners for £20,000 which are put into use on 20th March 2011. These are expected to last five years and to have a residual value of £1,000. The company's year-end is 30th April.

Decrease in useful life: Immediately prior to producing their accounts for the year ended 30th April 2014 management find out that the manufacturer of the scanners does not intend to produce new software drivers for the new operating system to which they intend to migrate on 30 September 2014. So they decide to reduce the useful life to three and a half years. The residual value is expected to be unchanged.

Objective: To show how the asset will be accounted for under IAS 16 in the company's year-end accounts from 30th Apr 2011 to 30th Apr 2015.

The carrying value of the asset will decrease rapidly in the third year in order to give effect to the reduced life-span.

If at some time during the expected lifetime a change took place with effect that no further economic benefit could be obtained from either further use or from disposal, the asset should be derecognised.

This is a simple example where, following the change in the view of the useful life, the depreciation is adjusted so as to arrive correctly at residual value at the appropriate date.