IFRS asset accounting

examples

- Asset with a change in economic life, impairment loss, revaluation

- Asset with increase in estimated useful life

- Asset with decrease in estimated useful life

- Asset subject to impairment

- Asset with reversal of impairment

- Asset with revaluation

- Asset with reversal of revaluation

- Asset with increase in residual value

- Asset with decrease in residual value

- Asset with increase in estimated useful life and reintegrated depreciation

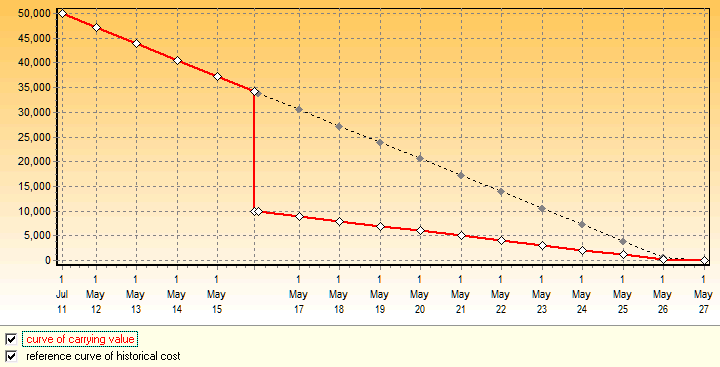

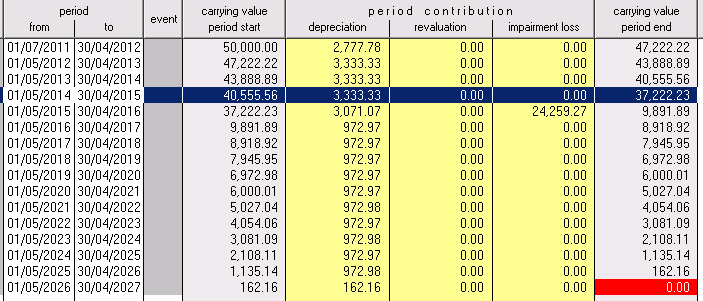

Asset subject to impairment

Background: Deadland Investments owns a piece of land adjacent to a new passenger ship terminal. The land lay vacant for several years, but shortly after the terminal commenced operation Deadland built a carpark for a total expenditure of £50,000, the carpark is put into operation on 1 July 2011. Management considers the development to have a useful life of 15 years and no residual value. The company's year-end is 30th April.

Impairment of asset: On 20th March 2016 Deadland learns the terminal is to close at the end of the year because of a disappointing volume of traffic. The management consider that some volume of business will remain but expect net revenues to suffer considerable reduction and now consider the recoverable amount to be £10,000 based on value in use. In this instance the value in use was the discounted value of net future cash flows.

Objective: To show how the asset will be accounted for under IAS 16 and IAS 36 in the company's year-end accounts from 30th April 2011 to the end of its useful life.

When preparing the accounts for the financial year ending 30th April 2016 under IAS the company should recognise the impairment as at 20th March 2016 which reduces the carrying value to £10,000 at that date. After that date the asset will be amortized over the remaining part of its useful life