IFRS asset accounting

examples

- Asset with a change in economic life, impairment loss, revaluation

- Asset with increase in estimated useful life

- Asset with decrease in estimated useful life

- Asset subject to impairment

- Asset with reversal of impairment

- Asset with revaluation

- Asset with reversal of revaluation

- Asset with increase in residual value

- Asset with decrease in residual value

- Asset with increase in estimated useful life and reintegrated depreciation

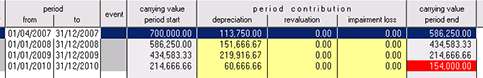

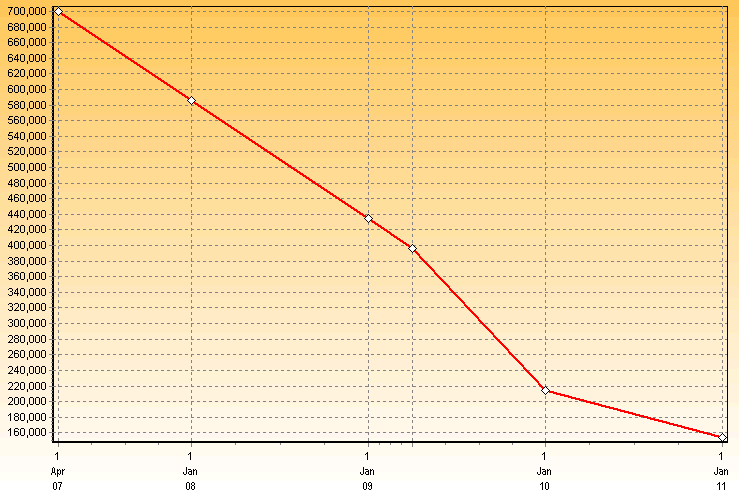

Asset with decrease in residual value

Background: Limolux Ltd hire out self-drive and chauffeur-driven luxury cars. On 1st April 2007 they purchase a fleet of new cars for £700,000. The company intends to operate these for three years and then sell them. During their ownership the company will account for the fleet as a single asset. The resale value after three years is estimated to be 35% of the cost. The company's year-end is 31st December.

Change in second-hand luxury car market: In the light of rising fuel costs and the shrinking economy on 31st March 2009 management conduct a review of the second-hand luxury market and they conclude the residual value of their fleet has fallen to 22% of cost.

Objective: To show how the asset will be accounted for under IAS 16 in the company's annual accounts from 31st Dec 2007 to 31st Dec 2010.

From the date upon which the new residual value is known the depreciation is calculated so as to write down the excess of the carrying amount over the residual value over the remaining life. In the year to 31st December 2010 the fleet has reached the end of its useful life (the period over which the asset is expected to be available for use by an entity) by 31st March 2000 and hence the depreciation charge is limited.