The most efficient structure for contactors (Tax year 6 Apr 2014 to 5 Apr 2015)

This is a very common question for persons carrying out temping work, whether through an agency or directly with a client. The question is whether it is worth arranging matters so that the client is invoiced directly (or via a 'personal service company' PSC) or whether to be treated as an employee of the client (or the temping agency).

The legal aspects of IR35 are dealt with elsewhere on this site, but this page looks at the tax implications of someone working on a temporary assignment with an hourly pay rate. The tax year is 2014-15. The contract being considered is for an hourly rate of pay and where the worker is working under an employment contract there is a current legal minimum paid holiday of 5.6 weeks. The employer will have to pay National Insurance of 13.8% on most of the wages. A 5 day week of 7 hours per day has been assumed, this being a common arragement. The hourly cost to an employer consists of the basic hourly rate on the contract plus employer's national insurance plus the cost of holiday pay and the national insurance thereon.

Where the worker chooses to invoice the client via a PSC the profit will remain in the company and will be subject to corporation tax on the company and potentially income tax and national insurance on any income distributed to the worker.

In the comparisons, the most tax efficient means of distribution of the PSC's income has been assumed. This consists of a basic salary being paid of £7,956 and the remainder of the profit being distributed via dividend.

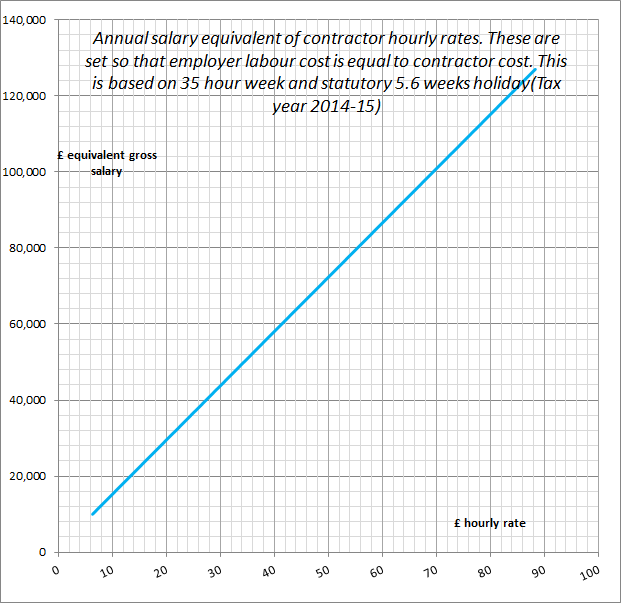

In preparing this graph, for each of a large series of annual salaries of an employee the annual cost to the employer and the annual net salary after tax were calculated. The annual cost to the employer was divided by the number of hours paid while present at work. This is 52 weeks less the statutory 5.6 weeks' holiday and 35 hours per week, giving 1,624 working hours.

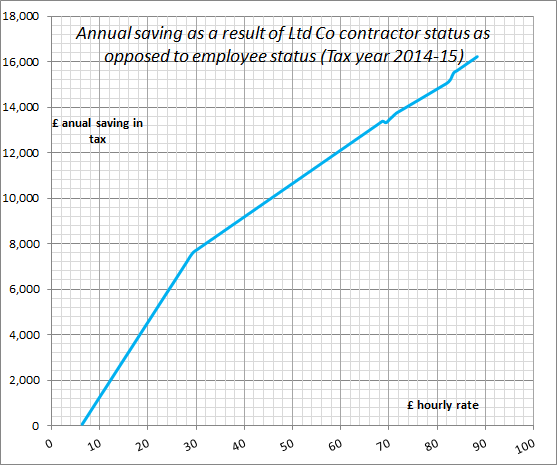

For a worker with £43,000 annual salary the annual cost to the employer is £47,836.07, the hourly employer's cost £29.46, the net annual salary £32,081.22, and the net hourly salary of the worker £19.75. To calculate how much the worker would earn net when billing the client through his Limited Company, the total annual fee billed was calculated (£29.49 x 1,624 hours). Next the net annual amount the company owner would receive was calculated. This was assuming he would pay himself using the most tax-efficient mix of salary and dividends. In this example this net annual income works out at £39,717.97 and the net hourly income £24.46, meaning that the PSC worker would receive 23.8% more income after tax.

The two scenarios are based on setting the hourly rate so that there is no difference in the employer's annual cost between the two scenarios.

The above chart shows the annual savings as a result of operating as a Ltd Company. In the above example with a charging rate of £29.46 per hour there is an annual saving of £7,636.75 (£39,717.97 minus £32,081.22). The kinks in the line are correct and are due to the personal allowance withdrawal rules.

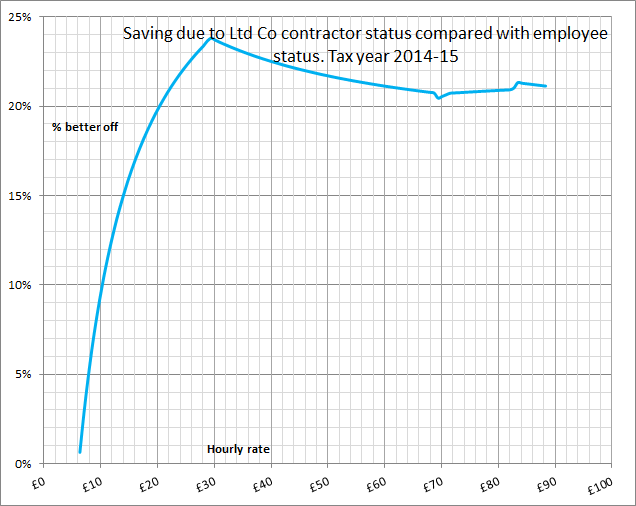

This illustrates the tax savings for the PSC worker using the same data as in the previous graph. Note that from around £25 per hour the savings start to slow down due to the fact that above £43,875 income (£42,475 in 2011-12) the tax rate rises from 20% to 40%. This can be avoided by capping the dividend with a view to extracting the income in later years using the 10% 'entrepreneurs relief' tax rate. Above around £50 per hour the withdrawal of personal allowances takes effect causing an effective 60% tax rate for some of the income above £100,000.

The above chart is "employer-neutral". In other words it shows the annual salary equivalent for an employer to consider hiring a contractor at an hourly rate. The line shows where the rates are equal in cost to the employer. Note that this line is not neutral for the contractor/employee since he will get a much better net income by operating through his PSC rather than as an employee. Employers may be aware of this and this may be a point of negociation in favour of the employer. On the other hand the employer would see some advantages in hiring a contractor: no notice period, low risk of employment tribunals etc. So there is scope for negociation either way.

There are a further advantages of operating as a limited company, such as the deductibility of travel costs from the company office to the place of work.

Although there are very large tax savings to be made, the admissibility of operating through a limited company depends on a number of facts which can in some cases be difficult rule upon. I have reproduced below the guidance from HMRC in this matter:

In order to answer this question it is necessary to determine whether the person works under a contract of service (employees) or under a contract for services (self-employed, independent contractor). For tax and NICs purposes, there is no statutory definition of a contract of service or of a contract for services. What the parties call their relationship, or what they consider it to be, is not conclusive. It is the reality of the relationship that matters.

In order to determine the nature of a contract, it is necessary to apply common law principles. The courts have, over the years, laid down some factors and tests that are relevant, which is included in the overview below.

As a general guide as to whether a worker is an employee or self-employed; if the answer is 'Yes' to all of the following questions, then the worker is probably an employee:

- Do they have to do the work themselves?

- Can someone tell them at any time what to do, where to carry out the work or when and how to do it?

- Can they work a set amount of hours?

- Can someone move them from task to task?

- Are they paid by the hour, week, or month?

- Can they get overtime pay or bonus payment?

If the answer is 'Yes' to all of the following questions, it will usually mean that the worker is self-employed:

- Can they hire someone to do the work or engage helpers at their own expense?

- Do they risk their own money?

- Do they provide the main items of equipment they need to do their job, not just the small tools that many employees provide for themselves?

- Do they agree to do a job for a fixed price regardless of how long the job may take?

- Can they decide what work to do, how and when to do the work and where to provide the services?

- Do they regularly work for a number of different people?

- Do they have to correct unsatisfactory work in their own time and at their own expense?