examples

- Asset with a change in economic life, impairment loss, revaluation

- Asset with increase in estimated useful life

- Asset with decrease in estimated useful life

- Asset subject to impairment

- Asset with reversal of impairment

- Asset with revaluation

- Asset with reversal of revaluation

- Asset with increase in residual value

- Asset with decrease in residual value

- Asset with increase in estimated useful life and reintegrated depreciation

Asset with changes in economic life, impairment loss, revaluation

The following example appears complex but shows the consequences of varying economic factors during a decade. The calculations involve no more than straight-line arithmetic, but it is essential for these to follow IFRS rules which are founded on long-standing economic and accounting principles.

Background:

New Sprint Ltd prints newspapers for several customers. Its accounting year-end is 30th April.

Fixed Asset purchase:

The company buys a printing press for £200,000 inclusive of all installation costs, and this is installed and ready for use on 15th April 2012. Management estimate the press will have a useful life of 12 years and a residual value of £15,000.

Impairment loss: Management find that due to over-capacity in the industry the market value of the printing press was just £160,000 at 30 Oct 2013. This printing press is a well-known model and the second-hand market value can be estimated reliably.

Useful life increase: One of their main customers ceases to use their services on 30th June 2014, but because of the reduced operating hours, management estimate that the useful life of the press will increase to 18 years.

Improvement in this business sector: On 31 Oct 2015 the market value is estimated to be £165,000. Increase in demand permits the company to operate the press under three shifts and from 31st Oct 2016 they reduce the overall expectation of useful life of the machine to 10 years.

Fair value policy: Under IAS 16 paragraph 31 the company has chosen the "Revaluation Model" in which all members of this class of plant and equipment shall be carried at fair value at the date of valuation less any subsequent accumulated depreciation and impairment losses.

Book entries: The task is to show how the asset will be accounted for under IAS 16 in the company's year-end accounts from 30th April 2012 to 30th April 2022.

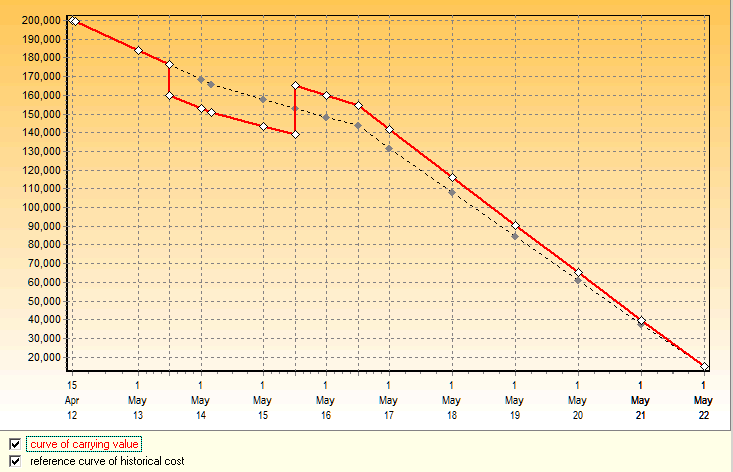

The asset will show a carrying value according to the graph: The financial year ending 30 Apr 2016 shows a partial reversal of impairment loss and a revaluation credit (both due to revaluation), and a lower depreciation charge (due to increase in estimated life). The carrying value in red in the final year is highlighted to draw attention to the fact that the estimated useful life has been exceeded and that conditions may be met for the asset to be derecognised.