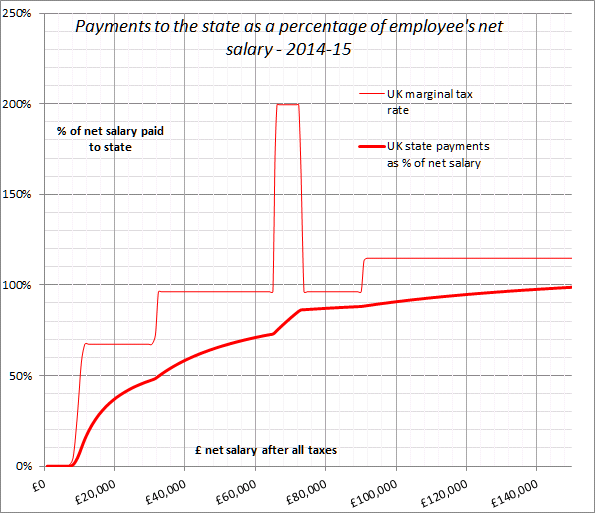

The UK still has a Himalayan marginal tax rate

Dating back to the Finance Act 2009 while Gordon Brown was Prime Minister we still have the silly band where the marginal rate of tax is near enough 200% of net salary.

If your salary is well above the £100,000 then you have to cross Mt Everest to reach the pastures of the 45% plateau.

If it is just above you should act before 5th April.

How do we get this mad rate of nearly 200%?

Well in the taxable income area of £100,000 to £120,000 the personal allowance is withdrawn at the rate of 50p for every £1 above £100,000. So, effectively, the 40% higher tax rate rises to 60%.

For an additional £1 above £100,000 the employee will have 60p deducted in PAYE and 2p in National Insurance (NI) thus receiving 38p. The employer will remit to the state 13.8p in NI, the 2p employee's NI and the 60p in PAYE. A total of 75.8p.

So the percentage of state payment to net salary is 75.8p/38p which is 199.47%.

Can this high tax area be avoided?

If your salary falls in the £100,000 to £120,000 band the simplest way to avoid the 62% tax rate is to buys some SIPPS. Because of the tax relief and the grossing up of the payment made by the government, for every 40p invested the amount of fund purchased is £1. So even if you are a strong disbeliever in the future performance of funds, this is an extremely favourable action to take.