Applying IAS17 Leases.

Complying with the provisions of IAS17 on leases can be quite challenging in real-life examples due to some quite difficult calculations. One way to improve understanding of the standard is to look at the following worked-example which could be used to benchmark any procedure you have devised to produce the required results:

Question: 15th Feb 2013 a company leases a large specialised lorry until 14th Feb 2018. The market value was £146,500. The leasing company bought this asset from a manufacturer for this price specifically to lease this asset. The contract defines 15 four-monthly payments of £10,465 starting 30th Apr 2013. (these are minimum lease payments). The residual value of the asset at the end of the contract is estimated to be £28,000. The lease is non-cancellable during this period and it is considered that substantially all the risks and rewards incidental to ownership of the asset are with the lessee. The lessee’s and lessor's year ends are 31st March. Show the summarised balance sheets and disclosures for each of the six year-ends starting 31st Mar 2013 under IAS17.

Answer: (all text in blue italics is taken from IAS17 applicable for annual periods beginning on or after 1 Jan 2005.)

Note on conventions used:

- Interest calculations cause inconsistent results when using connected strings of dates due to different days in months and leap years. In common with many financial practices the year is considered to consist of 12 months of 30 days.

- All interest calculations are performed using exponents of date differences calculated as in (1) above. So the coefficient applied to a capital amount at date d1 to determine its value at date d2 subject to interest at rate i is (1+i)exp(d2-d1). This is applied consistently and no approximations are used to spread interest by other means.

- The start date is expressed 1 day earlier to reflect the fact that contracts are generally deemed to commence at 00h00 and to end at 24h00

Comments on the answer given: The calculations are quite complex and any person attempting their own for the first time might run into myriad rounding differences and discrepancies. This is likely to be due to choices made in rounding the results. In fact the use of standard arithmetical functions of the PC can produce a rapid calculation without rounding errors. In practice para. 26 of the standard refers to the use of approximation to simplify the calculation, whereas this practice might result in additional time spent dealing with rounding differences. Accountants know that the rounding checks should be done at the very last stage of any report due to be issued to the public.

Step 1: Determine the classification of the lease:

A finance lease is a lease that transfers substantially all the risks and rewards incidental to ownership of an asset. Title may or may not eventually be transferred.

Guaranteed residual value is:(a) for a lessee, that part of the residual value that is guaranteed by the lessee or by a party related to the lessee (the amount of the guarantee being the maximum amount that could, in any event, become payable); and (b) for a lessor, that part of the residual value that is guaranteed by the lessee or by a third party unrelated to the lessor that is financially capable of discharging the obligations under the guarantee.

Unguaranteed residual value is that portion of the residual value of the leased asset, the realisation of which by the lessor is not assured or is guaranteed solely by a party related to the lessor.

This lease is considered to be a finance lease by both parties. Substantially all the risks and rewards are transferred to the lessee, the main ones being to ensure the asset generates sufficient revenue and does not lie idle. If the lessee has an option to purchase the asset at an advantageous price at the term of the lease this purchase price is considered to be part of the minimum lease payments. However this is not the case and from the lessee’s viewpoint the machine has no residual value at the end of the contract. The lessor estimates the residual value of the machine to be nil at the end of the fifteen years. The lessee considers the residual value of the machine to be zero since he will cease to own the machine. The lessee has the use of this asset over fifteen years and one month, and will apply depreciation to the asset to reduce the carrying value to zero over this period on a straight-line basis.

Step 2: Calculate the interest rate implicit in the lease:

The interest rate implicit in the lease is the discount rate that, at the inception of the lease, causes the aggregate present value of (a) the minimum lease payments and (b) the unguaranteed residual value to be equal to the sum of (i) the fair value of the leased asset and (ii) any initial direct costs of the lessor.

So under IAS17 the “rate implicit in the lease” is the essential discount rate used in calculations.

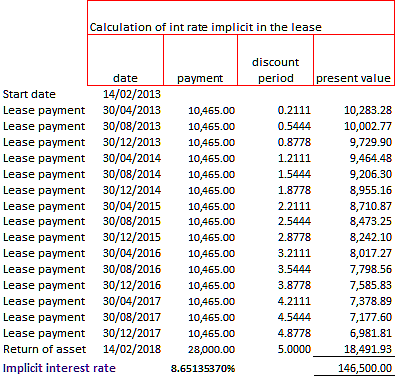

Figure 1 Calculation of interest rate implicit in the lease, taken from an Excel spreadsheet. Note that the lease term is a period of five years and one day since the start date is considered to be a full 24 hour day as is the end date. This is achieved more simply by setting the start date for calculations one day earlier.

Step 3: Calculate apportionment of the finance charge for lessor (and lessee):

At the commencement of the lease term, lessees shall recognise finance leases as assets and liabilities in their statements of financial position at amounts equal to the fair value of the leased property or, if lower, the present value of the minimum lease payments, each determined at the inception of the lease. The discount rate to be used in calculating the present value of the minimum lease payments is the interest rate implicit in the lease, if this is practicable to determine; if not, the lessee’s incremental borrowing rate shall be used. Any initial direct costs of the lessee are added to the amount recognised as an asset.

The lower of fair value and present value of minimum lease payments at inception is £128,008.07 (equal to the present value of the minimum lease payments).

Minimum lease payments shall be apportioned between the finance charge and the reduction of the outstanding liability. The finance charge shall be allocated to each period during the lease term so as to produce a constant periodic rate of interest on the remaining balance of the liability.

This rule gives rise to the following table for the apportionment of the lease payments using the above discount rate

Figure 2 Apportionment of lease payments between interest and capital (taken from an Excel spreadsheet).

The present value of the minimum lease payments is lower than the fair value of the asset, so this lower value is taken.

The lessee’s finance costs are allocated over the period of the payments which is 1 ½ months shorter than the period of the lease. This is logical since after all the lease payments have been made there can be no further finance costs.

The above lease analysis does not yet deal with splitting the interest into accounting periods. The allocation of interest between accounting periods requires a careful choice of method in order to avoid persistent rounding differences and conflicts with data shown in disclosures. Interest could be apportioned on a straight line basis between accounting periods, or it could be calculated using simple arithmetic when needed. Using simple arithmetic, the interest on £1,000 at 10% for 1 ½ years would be £150. However the accepted formula for calculating the interest is 1000 x ((1.1)^1.5-1) giving £153.69. Definitions regarding time spans involving date subtraction need care. For example, whether a leap year is as long as a normal year and whether February is as long a month as March. To resolve these problems, in common with most banking and accounting practices, the year is divided into 12 equal months of 30 days, and any date involving the last day of any month is considered to be the 30th. This refers to the 360/30 convention in banking terms.

The lessee’s finance charges for each accounting period, calculated exponentially, and depreciation charges calculated on a straight line basis are as follows:

Step 4: Preparation of disclosure information for lessor (and lessee):

Lessees shall, in addition to meeting the requirements of IFRS 7 Financial Instruments: Disclosures,

make the following disclosures for finance leases:

(a) for each class of asset, the net carrying amount at the end of the reporting period.

(b) a reconciliation between the total of future minimum lease payments at the end of the reporting period, and their present value. In addition, an entity shall disclose the total of future minimum lease payments at the end of the reporting period, and their present value, for each of the following periods:

(i) not later than one year; (ii) later than one year and not later than five years; (iii) later than five years.

(c) contingent rents recognised as an expense in the period.

(d) the total of future minimum sublease payments expected to be received under non-cancellable

subleases at the end of the reporting period.

(e) a general description of the lessee’s material leasing arrangements including, but not limited

to, the following:

(i) the basis on which contingent rent payable is determined;

(ii) the existence and terms of renewal or purchase options and escalation clauses; and

(iii) restrictions imposed by lease arrangements, such as those concerning dividends, additional debt, and further leasing.

Lessors shall, in addition to meeting the requirements in IFRS 7, disclose the following for finance

leases:

a) a reconciliation between the gross investment in the lease at the end of the reporting period, and the present value of minimum lease payments receivable at the end of the reporting period. In addition, an entity shall disclose the gross investment in the lease and the present value of minimum lease payments receivable at the end of the reporting period, for each of the following periods:

(i) not later than one year;

(ii) later than one year and not later than five years;

(iii) later than five years.

(b) unearned finance income.

(c) the unguaranteed residual values accruing to the benefit of the lessor.

(d) the accumulated allowance for uncollectible minimum lease payments receivable.

(e) contingent rents recognised as income in the period.

(f) a general description of the lessor’s material leasing arrangements.

The following data tables form the basis of the disclosure information over the period of the lease:

Figure 3 Lessee’s interest charges apportioned over all the accounting periods (taken from an Excel spreadsheet). Depreciation of the lessee’s asset under finance lease has been depreciated on a straight-line basis over the lease term.

Figure 4 Lessor disclosure information

Step 4 Preparation of lease accounting data:

Lessors shall recognise assets held under a finance lease in their statements of financial position and present them as a receivable at an amount equal to the net investment in the lease. The recognition of finance income shall be based on a pattern reflecting a constant periodic rate of return on the lessor’s net investment in the finance lease. [Net investment in the lease is the gross investment in the lease discounted at the interest rate implicit in the lease.] [Gross investment in the lease is the aggregate of:(a) the minimum lease payments receivable by the lessor under a finance lease, and (b) any unguaranteed residual value accruing to the lessor.]

A lessor aims to allocate finance income over the lease term on a systematic and rational basis. This income allocation is based on a pattern reflecting a constant periodic return on the lessor’s net investment in the finance lease. Lease payments relating to the period, excluding costs for services, are applied against the gross investment in the lease to reduce both the principal and the unearned finance income.

Lessees: Minimum lease payments shall be apportioned between the finance charge and the reduction of the outstanding liability. The finance charge shall be allocated to each period during the lease term so as to produce a constant periodic rate of interest on the remaining balance of the liability.

The following accounting data provide the values of the entries in the lessee and lessor’s books over the lease term:

Figure 5 Accounting entries in lessee’s and lessor's books

Typical contents of notes to financial statements relating to leases:

Leasing

Leases are classified as finance leases whenever the terms of the lease transfer substantially all the risks and rewards of ownership to the lessee. All other leases are classified as operating leases.

The Company as lessor: Amounts due from lessees under finance leases are recognised as receivables at the amount of the Company’s net investment in the leases. Finance lease income is allocated to accounting periods so as to reflect a constant periodic rate of return on the Company’s net investment outstanding in respect of the leases.

Rental income from operating leases is recognised on a straight-line basis over the term of the relevant lease. Initial direct costs incurred in negotiating and arranging an operating lease are added to the carrying amount of the leased asset and recognised on a straight-line basis over the lease term.

The Company as lessee

Assets held under finance leases are initially recognised as assets of the Company at their fair value at the inception of the lease or, if lower, at the present value of the minimum lease payments. The corresponding liability to the lessor is included in the consolidated statement of financial position as a finance lease obligation. Lease payments are apportioned between finance expenses and reduction of the lease obligation so as to achieve a constant rate of interest on the remaining balance of the liability. Finance expenses are recognised immediately in profit or loss, unless they are directly attributable to qualifying assets, in which case they are capitalised in accordance with the Company’s general policy on borrowing costs. Contingent rentals are recognised as expenses in the periods in which they are incurred.

Operating lease payments are recognised as an expense on a straight-line basis over the lease term, except where another systematic basis is more representative of the time pattern in which economic benefits from the leased asset are consumed. Contingent rentals arising under operating leases are recognised as an expense in the period in which they are incurred.

In the event that lease incentives are received to enter into operating leases, such incentives are recognised as a liability.

The aggregate benefit of incentives is recognised as a reduction of rental expense on a straight-line basis, except where another systematic basis is more representative of the time pattern in which economic benefits from the leased asset are consumed.

Obligations under finance leases

Leasing arrangements: The Company leased certain of its manufacturing equipment under finance leases. The average lease term is 6 years

The Company does not intend to exercise its option to purchase the equipment for a nominal amount at the end of the lease term.

The Company’s obligations under finance leases are secured by the lessors’ title to the leased assets.

Interest rates underlying all obligations under finance leases are fixed at the contract date at 8.65% per annum.