examples

- Asset with a change in economic life, impairment loss, revaluation

- Asset with increase in estimated useful life

- Asset with decrease in estimated useful life

- Asset subject to impairment

- Asset with reversal of impairment

- Asset with revaluation

- Asset with reversal of revaluation

- Asset with increase in residual value

- Asset with decrease in residual value

- Asset with increase in estimated useful life and reintegrated depreciation

Asset with reversal of revaluation

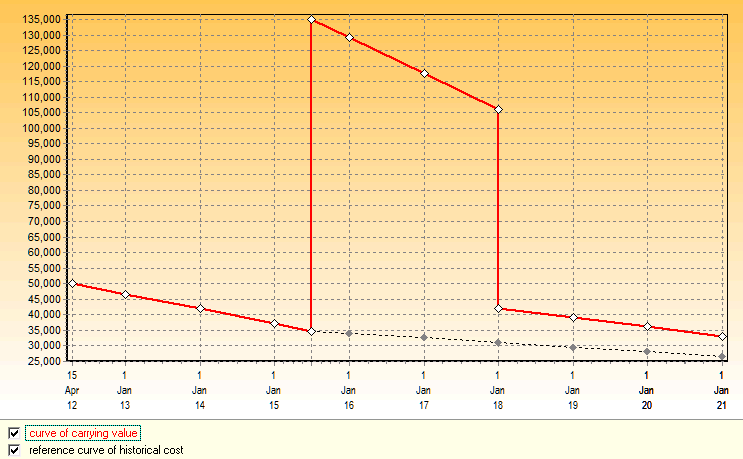

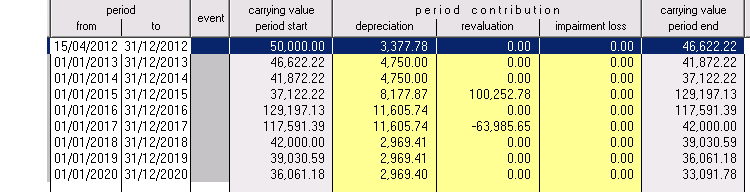

Background: Nostalgic Trinkets Ltd has designed some interesting household ornaments and kitchen tools emphasizing aesthetic appeal, functionality, durability and resemblance to 19th century articles. These goods are made from hard metals such as brass and stainless steel. To begin production management find a factory which has ceased activity with a number of machines such as lathes and presses. These are acquired from the liquidator for a bargain price of £50,000 on 15 April 2012. Management considers the useful life to be 7 years and the residual value to be £12,000. The company's year-end is 31st December.

Production is a success: The production begins just a few days after the acquisition and the demand and price acceptance is very good. Two years later several new products have been introduced and the profit for the first year is £200,000 and the second year £280,000. Management become more aware that acquiring new machines would cost near to ten times the price. They appoint professional valuers to carry out a detailed valuation. Their report as at 30 June 2015 indicates a valuation of £135,000 for the machines, a future useful life 10 years and a residual value of £20,000 .

Fair value policy:

Under IAS 16 paragraph 31 the company chooses the "Revaluation Model" in which all members of this class of plant and equipment shall be carried at fair value at the date of valuation less any subsequent accumulated depreciation and impairment losses.

Asset revaluation: Management decide to incorporate the new valuation, useful life and residual value estimations into their books as at 30 June 2015.

Overseas competition: During 2017 management perceive that they had the good fortune of being in at the beginning of a boom market in vintage household goods and that a number of overseas players were increasing their market share. Several domestic manufacturers were changing activity and putting their machinery up for sale. As at 31st December 2017a new valuation report gives a fair of £42,000.

Objective: To show how the asset will be accounted for under IAS 16 and IAS 36 in the company's year-end accounts from 31st Dec 2012 to 31st Dec 2020.

Note that the recoverable amount (the higher of fair value less costs to sell and the value in use) is of use when considering impairment or reversal of impairment, but the fair value must be the basis of any revaluation above existing carrying value. Once the revaluation model has been chosen, future revaluations need to be made often enough to ensure the carrying amounts do not differ materially from the fair value basis at the end of each reporting period.